I've seen this before - the hype, the speculation, the predictions of unprecedented growth. Back in 2017, when Bitcoin first soared to nearly $20,000, many thought it was the dawn of a new era. But what many newcomers don't realize is that the crypto landscape is ever-changing, with market cycles that can be both exhilarating and devastating.

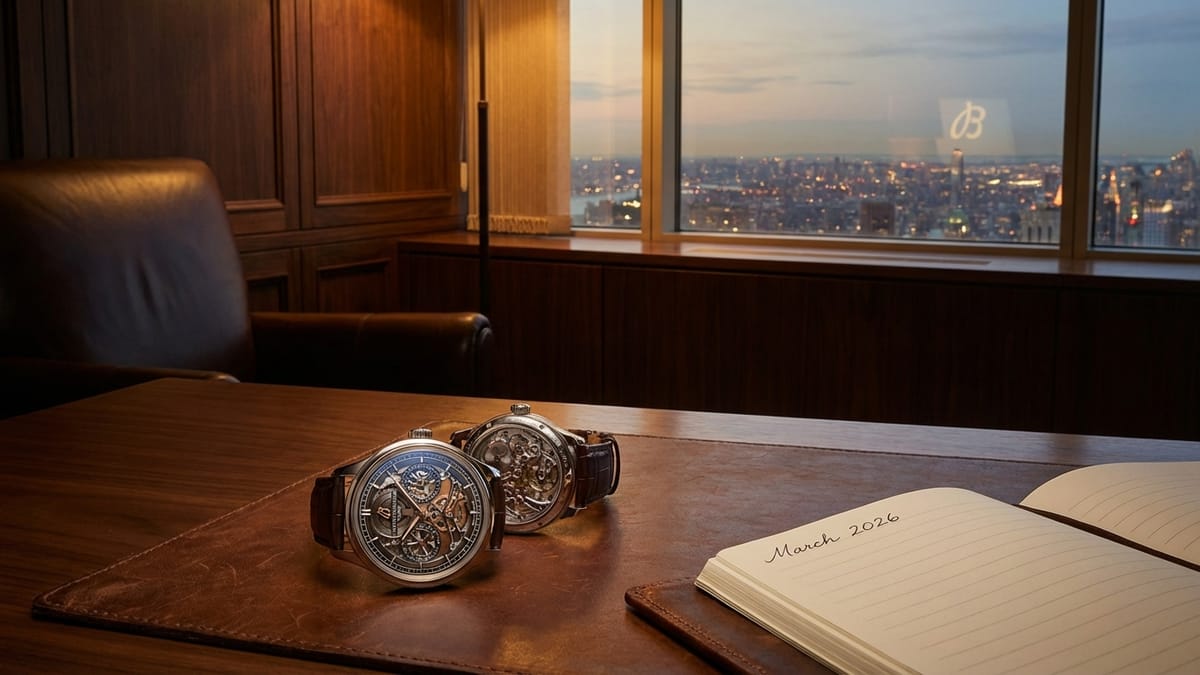

Today, as Grayscale predicts Bitcoin will reach new all-time highs by March 2026, it's essential to approach this forecast with a mix of optimism and skepticism. The reasoning behind this prediction - a more supportive regulatory environment and weakening fiat currencies - is sound, but the crypto market is notoriously unpredictable. As someone who has lived through multiple market cycles, I know that it's crucial to focus on the fundamentals rather than getting caught up in the hype.

The Regulatory Environment: A Key Factor

The regulatory landscape is indeed becoming more favorable for cryptocurrencies. With more countries acknowledging the potential of crypto and blockchain, the sector is likely to see increased investment and adoption. However, it's also important to remember that regulations can change rapidly, and what seems supportive today might not be tomorrow. For instance, the crypto news and web3 news often highlight the importance of clear regulations for the growth of the crypto sector.

- The rise of alternative stores of value is driving demand for cryptocurrencies like Bitcoin and Ethereum.

- A weakening fiat currency environment could further boost demand for crypto assets.

- Regulatory clarity is crucial for the long-term growth and stability of the crypto sector, making blockchain news and finance news essential for investors.

Separating Hype from Reality

As the crypto sector prepares for what could be a pivotal year, it's vital to separate the hype from the reality. While predictions of new all-time highs can be exciting, they should also be viewed with a critical eye. What if the regulatory environment takes a turn for the worse? What if global economic conditions suddenly shift? As a seasoned investor, it's essential to consider all scenarios, not just the optimistic ones. Staying informed through reputable crypto blogs and following the latest developments in crypto hot topics can help investors make more informed decisions.

The key to navigating the crypto landscape successfully is not to get caught up in the hype but to focus on the fundamentals and stay informed about the latest web3 news and blockchain news.

For everyday people looking to invest in crypto, the prediction by Grayscale should be a signal to do their own research and not rely solely on hype or predictions. Understanding the basics of cryptocurrency, including how Bitcoin and Ethereum work, is crucial. Here are some key takeaways:

- Invest for the long term, as crypto markets can be highly volatile, and staying up-to-date with the latest crypto news can help.

- Diversify your portfolio to minimize risk, considering both the potential of cryptocurrencies like Bitcoin and the stability of more traditional investments.

- Stay informed but avoid making investment decisions based on speculation or fear, and always consider the potential impact of regulatory changes on the crypto sector.

My Take

As someone who has been in the crypto space for years, I've learned to approach predictions with a healthy dose of skepticism. While Grayscale's forecast is certainly positive, it's essential to remember that the crypto market is inherently unpredictable. My advice? Focus on the fundamentals, stay informed, and always keep a level head. For those interested in the latest crypto news, web3 news, and blockchain news, there are many reputable sources available, including CoinDesk and BeInCrypto.

In the end, whether Bitcoin reaches new all-time highs by March 2026 or not, the real victory will be in the continued growth and maturity of the crypto sector, driven by innovation, regulatory clarity, and investor wisdom. As the crypto sector continues to evolve, it's essential to stay informed about the latest developments in crypto hot topics, blockchain news, and finance news.